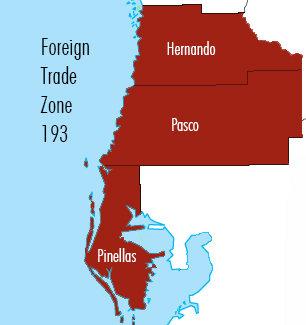

Foreign Trade Zone 193

For Pinellas, Pasco & Hernando Counties

Foreign-Trade Zones (FTZ) are secured, designated locations around the United States in or near a U.S. Customs Port of Entry where foreign and domestic merchandise is generally considered to be in international commerce and outside of US Customs territory. As a result, activated businesses in an FTZ can reduce or eliminate duty on imports and take advantage of other benefits to encourage foreign commerce within the United States.

Is an FTZ right for me?

- Do you manufacture, assemble or process imports?

- Do you export previously imported materials?

- Do you regularly pay more than $485/week in merchandise processing fees?

- Do you have to wait long periods of time for your orders to get through customs?

- Do you scrap reject, destroy, waste or return some of your imports?

Save Time & Money

- Streamline Customs Clearance. A Foreign Trade Zone (FTZ) is a secured site within the United States, but technically considered outside of U.S. Customs’ jurisdiction, allowing shippers to streamline Customs clearance.

- Operate more efficiently. Efficiently manage cash flow and save a significant amount of money on imported cargo shipments or manufacturing & distribution operations by using FTZ 192.

- Room to grow. FTZ 193 Operates under the Alternative Site Framework (ASF), which extends the zone to include three counties and more than 2,000 square miles in the Tampa Bay region.

- Easy integration. The FTZ’s ASF allows for easy integration into your company’s existing site/location.

- Fast approvals. Storage and distribution sites can be approved in 30 days; manufacturing and processing plants can be approved within 120 days.

- Superior sites. Some of the best industrial land sites in the entire United States are available within FTZ 193.

Defer and Reduce Taxes

- Defer customs duties and taxes until merchandise is transferred from the FTZ to domestic market.

- Reduce merchandise processing/entry fees substantially with just one entry filed each week and just one fee per entry.

- Reduce duties on goods processed or assembled in the FTZ when imported components have a higher duty rate than the finished goods.

- Eliminate duties entirely on scrap, damages, zone transfers, and on goods re-exported.